If you’ve been injured in a car accident, you may be wondering what to do next. After you’ve received care, the first step is to contact a Concord, NC, car accident lawyer. A good lawyer can help you get the compensation you deserve for your injuries. They will handle all of the paperwork and negotiations with the insurance company so that you can focus on recovering.

At The Law Offices of Jason E. Taylor, our Concord car accident lawyers have years of experience helping car accident victims get the compensation they deserve. We will work with the insurance company to ensure that you are fairly compensated for your losses. Contact us today for a free consultation.

Why Should I Hire a Concord Car Accident Lawyer?

There are a few reasons you should consider hiring a Concord car accident lawyer. If you’ve been injured in an accident, you may be entitled to compensation for your medical bills, lost wages, and pain and suffering.

An experienced lawyer will know how to negotiate with the insurance company to get you the best possible settlement. If your case goes to trial, our lawyers will be able to represent you in court and get you the justice you deserve.

What Should I Do After a Car Accident in Concord, North Carolina?

If you’ve been involved in a motor vehicle accident, the first step is to seek medical attention. Even if you don’t think you’re injured, it’s important to get checked out by a doctor. After you’ve seen a doctor, the next step is to contact a Concord, NC, car accident lawyer. A lawyer can help you understand your rights and get the compensation you deserve for your injuries.

Don’t wait to hire a lawyer after an accident. Contact us today to schedule a free consultation with one of our experienced Concord car accident lawyers. We will review your case and answer any questions you have about your legal rights.

How Much Is My Case Worth?

The sooner you call, the sooner we can start working on your case. The value of most car accident claims depends on several factors, including the severity of your injuries and the amount of damages you’ve incurred.

Economic Damages

Economic damages are those that have a specific monetary value, such as:

- Medical bills are the costs of medical treatment that you have received due to your car accident. These damages may include rehabilitation, surgery, ambulance costs, and any future medical expenses you may incur due to your injury.

- Lost wages include any income you have lost due to your injuries from the car accident.

- Property damage is the damage to your vehicle or other personal property due to the accident.

Non-Economic Damages

In addition to economic damages, you may also be entitled to non-economic damages. These damages are more difficult to quantify, such as pain and suffering, emotional distress, and loss of enjoyment of life.

Punitive Damages

In some cases, punitive damages may also be available where the conduct of the person at fault is particularly egregious. Punitive damages are designed to punish the wrongdoer and deter future misconduct.

Filing a Wrongful Death Claim

If you have lost a loved one in a car accident, you may be able to file a wrongful death claim. A wrongful death claim is a civil lawsuit that seeks to recover damages for the loss of a loved one. Damages you can recover include:

- Funeral and burial expenses

- Loss of love, companionship, and support

- Lost earnings and benefits

- Pain and suffering of the deceased

- Punitive damages may also be available in a wrongful death claim.

What Our Concord Car Accident Lawyers Will Do for You

Our Concord car accident lawyers can help you get the compensation you deserve if you’ve been injured in a car accident. Our car accident lawyers will:

Help You Understand Your Rights

You have certain rights after an accident, and it’s important that you understand them. Our lawyers will sit down with you and walk you through the claims process and what will happen in each stage.

Gather Evidence

We will collect all of the evidence we need to prove a strong case on your behalf. This may include photographs of the accident scene, witness statements, and medical records.

Handle all the Paperwork

Paperwork piles up after an auto accident and can contribute to your stress. Our lawyers will handle all the paperwork and legal details so you can focus on recovering.

Calculate Your Damages

You may be entitled to compensation for your medical bills, lost wages, and pain and suffering. Our lawyers will calculate the full extent of your damages so we can get you the maximum amount of financial compensation possible.

Investigate Your Claim

We will thoroughly investigate your claim to identify all responsible parties. We will also work with experts in accident reconstruction and other fields to establish a strong case on your behalf.

Negotiate with the Insurance Company

Insurance companies are often more interested in protecting their bottom line than they are in paying out claims. Our experienced lawyers know how to negotiate with insurance companies to get you the best possible settlement.

Take Your Case to Court

If we cannot reach a fair settlement with the insurance company, we will take your case to court. Our experienced trial lawyers will fight for you in court and get you the justice you deserve.

Get You the Compensation You Deserve

Our goal is to get you the full compensation you deserve for your injuries. We have a proven track record of success in car accident cases, and we will fight for you every step of the way.

Factors that May Impact Your Concord Car Accident Claim

The amount of compensation you recover in your Concord car accident claim may depend on several factors. These include:

The Statute of Limitations in North Carolina

The statute of limitations is the deadline for filing a lawsuit. In North Carolina, you usually have three years from the date of your accident to file a personal injury claim. If you don’t file your claim within this time frame, you will be forever barred from doing so. The statute of limitations in your particular case is one of the first things you and your lawyer should discuss.

Contributory Negligence in North Carolina

North Carolina follows the law of contributory negligence. This means that if you are even partially at fault for the motor vehicle crash, you will be barred from recovering damages.

For example, if you were speeding at the time of your accident and the other driver was texting, you may be considered partially at fault. As a result, you would be barred from recovering any damages from the other driver.

The best way to avoid this outcome is to hire an experienced car accident lawyer before you give any statements to an insurance company who can investigate your case and prepare a strong argument on your behalf.

The Severity of Your Injuries

The severity of your injuries will also play a role in the outcome of your case. If you have suffered serious or permanent injuries, you will likely be entitled to more damages than if you had only suffered minor injuries.

For example, if you suffered from traumatic brain injuries, you should be entitled to more compensation than if you had only suffered a minor cut.

The severity of your injuries will also impact the amount of time it takes to resolve your case. If you have suffered serious injuries, it may take longer to recover and reach maximum medical improvement. As a result, it may take longer to settle your case.

Speak with a Car Accident Lawyer in Concord Today

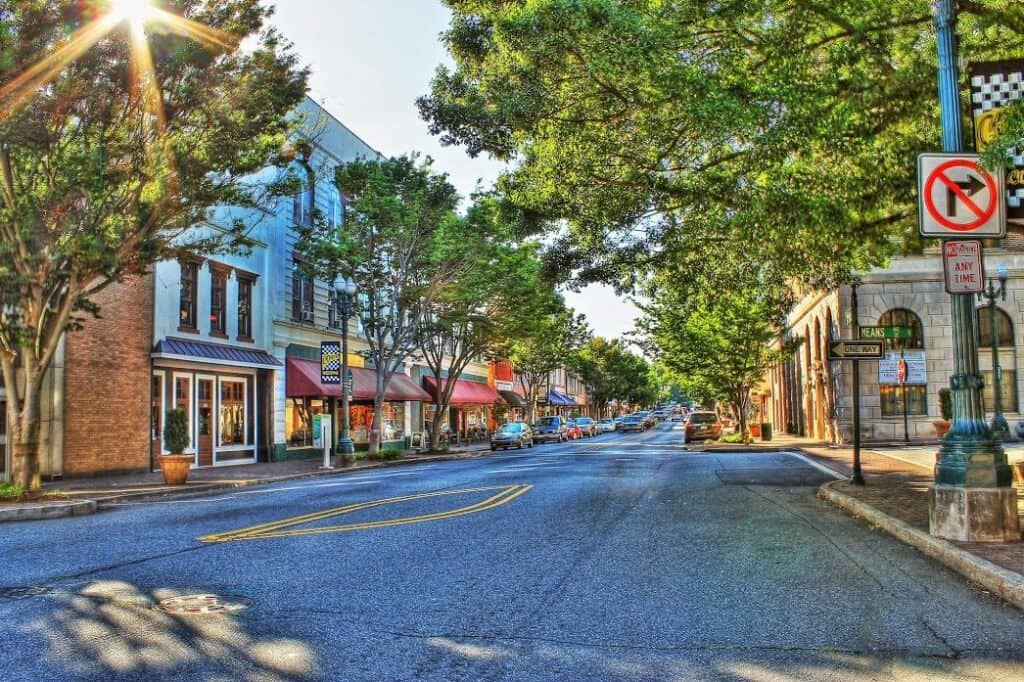

According to the North Carolina Department of Motor Vehicles, over 3,000 car accidents occurred in Concord in 2019. Unfortunately, auto accidents have become more and more common in recent years, and if you have been injured in one due to someone else’s negligence or recklessness, you deserve fair compensation for your injuries.

Our Concord auto accident attorneys have experience with all types of personal injury claims. We are not afraid to take on insurance companies to help you obtain fair compensation. We value the attorney-client relationship and will work tirelessly to protect your rights.

Contact our law firm today for your free initial consultation and learn more about what we can do to help you. We will answer your questions and explain all of your legal options.