The Dangers of Motorcycle Accidents

Motorcyclists are vulnerable on the road and are more likely to suffer from serious injuries than those in vehicles. They do not have the same level of protection that other motorists have, and they are often harder to see than other vehicles on the road. Motorcyclists can also be easily knocked off their bikes by other vehicles or obstacles in the roadway.

These factors make it essential for motorcycle riders to take extra precautions. They should always wear protective gear, including a helmet, and they should be aware of their surroundings. Unfortunately, even the most cautious riders can be involved in accidents because you’ve constantly got to be on the lookout for what the other guy is doing.

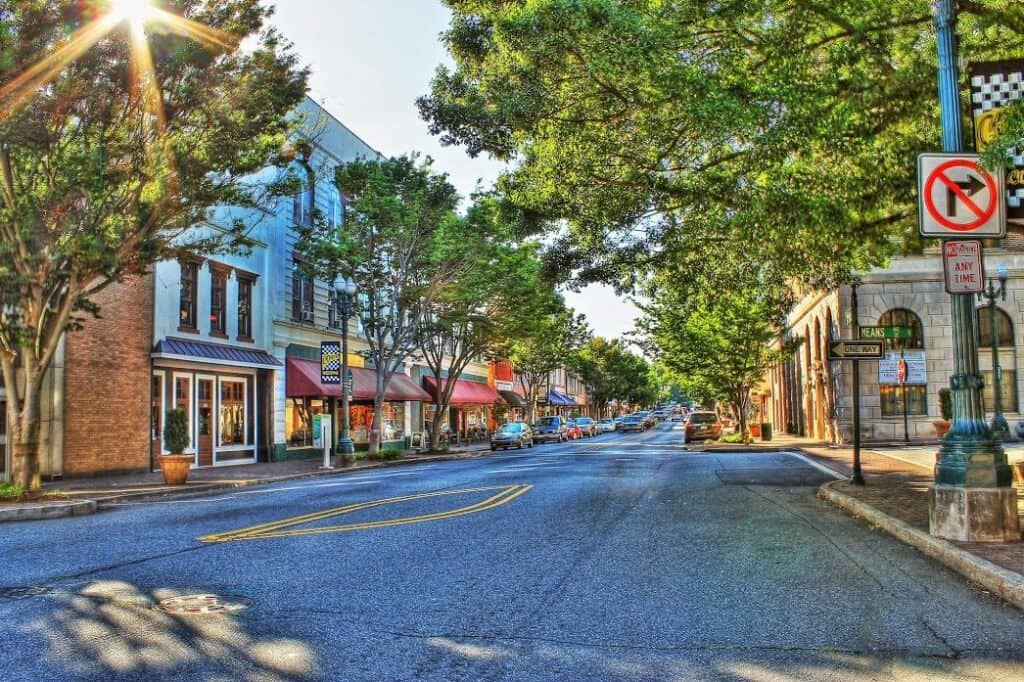

Common Causes of Motorcycle Accidents in Concord, NC

Many different factors can contribute to a motorcycle accident. Most motorcycle accidents occur due to the negligence of the other driver. Other times, it is the fault of the motorcycle rider. And sometimes, it is the fault of both parties. Some common causes of motorcycle accidents include:

- Speeding

- Driving under the influence of drugs or alcohol

- Distracted driving

- Failure to yield the right of way

- Poor road conditions

If you have been involved in a motor vehicle accident involving a motorcycle, it is important to contact a Concord, NC, motorcycle accident lawyer as soon as possible.

What Should I Do After a Motorcycle Accident in Concord, NC?

If you have been involved in a motorcycle accident, there are some important steps that you should take.

- Seek medical attention as soon as possible. Even if you don’t think you are injured, it is always better to be safe than sorry.

- Gather evidence from the accident scene. This can include taking photos of the damage to your bike, the scene, getting the contact information of any witnesses, and filing a police report.

- Contact a Concord lawyer as soon as possible. Our personal injury attorneys can help you file your claim, protect your rights, and get you the compensation you deserve.

What Are Some Common Injuries Sustained in Motorcycle Accidents?

Some of the most common injuries sustained in motorcycle accidents include:

- Road rash is a serious injury that can lead to infection.

- Broken bones can take months to heal, and some may never heal properly or need surgery.

- Spinal cord injuries can cause paralysis or other life-changing impairments.

- Traumatic brain injuries are one of the most serious injuries motorcyclists can suffer from after an accident and often require extensive medical treatment.

If you have been involved in a motorcycle accident, it is important to seek medical attention as soon as possible.

When Should I Hire a Concord, NC Motorcycle Accident Lawyer?

Ideally, you should contact an accident lawyer as soon as possible after the collision. This will allow the lawyer to gather evidence and eyewitness testimony while it is still fresh. It will also give the lawyer more time to build a strong case on your behalf. However, even if you wait to contact a lawyer, we may still be able to help you.

How Much Does a Motorcycle Accident Lawyer in Concord, NC Cost?

Most attorneys work on a contingency basis. This means you don’t pay any money until you receive a settlement. The attorney’s fee is a percentage of the total amount recovered.

You should not let the cost deter you from seeking legal help. The lawyers at our firm offer free consultations to get more information about your case without any obligation to you.

What Should I Expect When I Meet with a Lawyer in Concord, NC?

When you meet with a lawyer, they will ask you questions about the accident and your injuries. They will also ask you about your medical treatment and any lost wages you have incurred. It is important to be honest with your lawyer and give them all of the information they need to establish a strong case.

Contact us today to schedule a free consultation with an accident lawyer. We are here to help you get the compensation you deserve.

Liability in Concord, NC Motorcycle Accidents

In North Carolina, drivers are required to carry liability insurance. This type of insurance will pay for the damages you suffer if you are involved in an accident that the other driver caused. If the other driver does not have insurance or is not enough to cover your damages, you may be able to file a claim with your own uninsured/underinsured motorist coverage policy or file a personal injury lawsuit against the responsible party.

In some cases, other parties may be liable for your injuries. For example, if you were involved in an accident caused by a defective motorcycle part. In that case, you may be able to file a product liability lawsuit against the manufacturer of the defective part.

Contributory Negligence in North Carolina Motorcycle Accidents

North Carolina is a contributory negligence state. This means that if you are found to be even partially at fault for an accident, you will not be able to recover any damages from the other party. This is why it is so important to have an experienced lawyer who can help prove that the other party was at fault for the accident, particularly in motorcycle claims, which are rife with possible contributory negligence.

Can I File a Wrongful Death Claim for a Motorcycle Accident in Concord, NC?

If you have lost a loved one in a motorcycle crash, you may be able to file a wrongful death claim. These claims are complex, and it is important to have an experienced lawyer on your side. The lawyers at our firm can help you determine who is liable for your loved one’s death and get you the compensation you deserve.

Contact our Concord Motorcycle Accident Attorneys

If you or a loved one has been involved in a motor vehicle collision involving a motorcycle, contact the lawyers at our firm today. Our lawyers take on insurance companies and negotiate with them to ensure that you receive fair treatment. We are also not afraid to go to trial when it’s in our client’s best interest.

Contact us today for your free case review and learn more about what we can do to help you. We will answer your questions and explain all of your legal options.