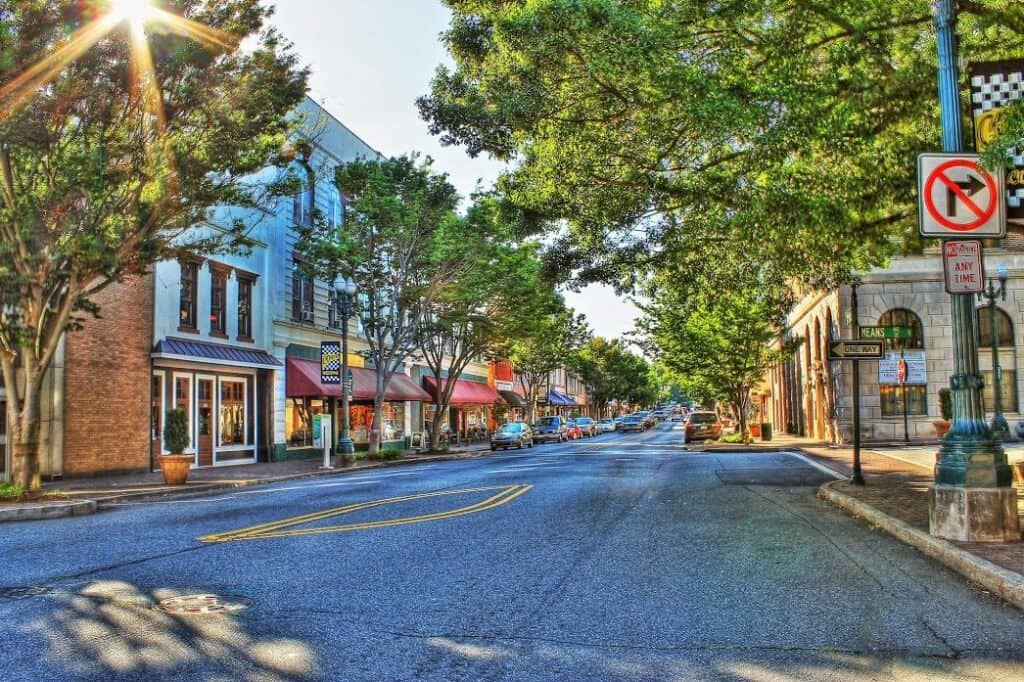

Concord is a city in Cabarrus County, North Carolina with a population of 107,697 residents in 2021. Concord is part of a larger metropolitan area just 12 miles north of Charlotte, NC with approximately 507,750 residents living nearby. Concord is home to NASCAR’s Charlotte Motor Speedway and Concord Mills.

Car insurance is required in North Carolina. You have undoubtedly seen one of State Farm’s many insurance commercials on TV. State Farm is one of the biggest insurance carriers in the United States. Insurance companies make money by collecting premiums and they make profits by paying out less in claims than is collected in premium dollars.

To do that, State Farm employs a team of insurance claims adjusters. These individuals will investigate your claim and determine whether or not it is valid and, if so, how much money they should pay out. This may seem like an easy task at first glance, but many factors affect the outcome of your claim.

If you are involved in an accident in Concord, don’t panic; there are steps you can take to ensure that you recover the money that you are owed following an accident.

At The Law Offices of Jason E. Taylor, we have over 25 years of experience representing insurance claimants in Concord. We understand this is a stressful time for you, so we will explain the entire process. We also take the time to investigate your claim thoroughly. Contact us today for a free consultation.

How To File A Claim With State Farm

Before you file a claim with State Farm, you should first consult with an experienced personal injury attorney. At The Law Offices of Jason E. Taylor, we can file a claim on your behalf and protect you from being taken advantage of by the insurance adjuster.

After we have reported the claim to State Farm, your claim will be assigned to a claims adjuster. Sometimes, the insurance company will want to take a recorded statement from you, but that is not always in your best interests to do so, and you should first consult with an attorney to discuss that matter before giving any statement to an adjuster. Your attorney will decide whether it is in your best interests to give a statement. If you have already given State Farm a statement prior to hiring an attorney, please let your attorney know. Oftentimes, State Farm adjusters will use a statement against you, in order to deny liability, so it is very important to contact an attorney prior to talking to State Farm.

Why Would a State Farm Claim be Denied in Concord, NC?

Unfortunately, the reality is that all auto insurance providers look for ways to limit how much money they payout in a settlement. In most cases, the reasons your claim is denied are legitimate, even if they can be questioned. Common legitimate reasons for denial include:

- Insufficient evidence to determine fault

- You were at fault for the accident

- The individual involved in the accident was not covered under the policy

- The individual did not seek medical treatment

- The premium was not paid, and the policy lapsed

Just because a claim has been denied does not mean that you should give up. A skilled attorney will examine every aspect of your claim, including the denial letter, to determine if a recovery can be made for you. Having the weight of an attorney and law firm behind you can often change the decisions that are made by insurance companies and their adjusters. An attorney can advocate on your behalf and give you the best chance to make a recovery in these circumstances.

How To Increase Your Chances Of Getting Compensation From State Farm in a Concord, NC Auto Insurance Claim

There are various ways to increase the likelihood of receiving the compensation you deserve from the at-fault driver’s car insurance company. When you file a claim, keep the following in mind:

Take Pictures of the Accident Scene and any Visible Injuries to Your Body

If you have a cell phone, take pictures of the accident scene immediately after the event. If you have sustained any visible injuries, then take a photo of those as well and keep updating the photos as the injury heals over time. This will help document the damage to all vehicles and injuries to your body as a result of the car accident.

Call 911

If you have been injured, call 911 to get emergency medical care. If you are not injured, you should still report the incident to law enforcement so that a report can be made of the car accident. When it is ready, get the accident report that is generated in the days following the wreck. The insurance company and your lawyer will need that information to best assist you with your claim.

Get Witness Contact Information

If there are any witnesses to the accident, get their contact information so that they can be reached after the accident in case there is any dispute about what happened.

Hire a Concord Car Accident Attorney

The insurance company has professionals working for them. If you were injured, you should consider hiring a Concord car accident attorney so that you have someone working for you. An attorney can ensure that all of your rights are protected while you get back on track with your life after the accident.

Keep Track of Your Medical Expenses

If you have been injured in an accident, keep track of your medical expenses. Your attorney and the insurance company will need this information when it comes time to resolve your claim and as they determine what amount of compensation would be fair for your injuries.

Go to Your Doctor Appointments and Follow the Treatment Plan

If you are injured in an accident, it is important to follow the treatment plan that your doctor gives you. Insurance companies love it when you fail to follow your doctor recommendations and will use that as an excuse to pay you less money for your injuries. Do not give the insurance company a reason to reduce the amount they pay you. For your health, it is always best to follow your doctor’s recommendations and it will make filing a successful claim easier as well.

Bad Faith Insurance Denials in Concord, NC

Insurance companies will sometimes deny your claim or handle your claim in a way that violates the law. Under North Carolina law, insurance companies and their adjusters owe their policyholders a duty to act in good faith. Failure to act in good faith is a violation of the law and some examples of Bad Faith may include the following:

- State Farm failing to investigate the claim

- Unreasonable delays in accepting or denying a claim

- Lack of communication

- Misrepresentation of the insurance policy

- Misrepresentation of facts related to the case

- Unreasonably underpaying the auto insurance claim

Bad faith insurance denials can devastate a person injured in an accident, especially when they cannot work. If this happens to you, contact an attorney as soon as possible so that they can begin working on your case right away.

Contact a Skilled Attorney for Help With a State Farm Auto Insurance Claim

When you need help with a State Farm auto insurance claim, contact the Concord car accident attorneys at the Law Offices of Jason E. Taylor. We are here to help and will fight for your rights so that you get the compensation you deserve.

Our firm is dedicated to helping each client get the best possible outcome for their case, which includes obtaining full and fair compensation for all damages incurred due to an accident caused by another driver’s negligence. Contact us today for a free case review.