Every year, speeding contributes to thousands of car accidents across Charlotte, North Carolina—causing preventable injuries, devastating losses, and unnecessary fatalities. At The Law Offices of Jason E. Taylor, we understand the life-altering impact a speeding-related accident can have on victims and their families. As your dedicated legal advocates, our mission is to fight for your right to justice, hold negligent drivers accountable, and help you recover the compensation you deserve.

The Alarming Reality of Speeding in Charlotte, North Carolina

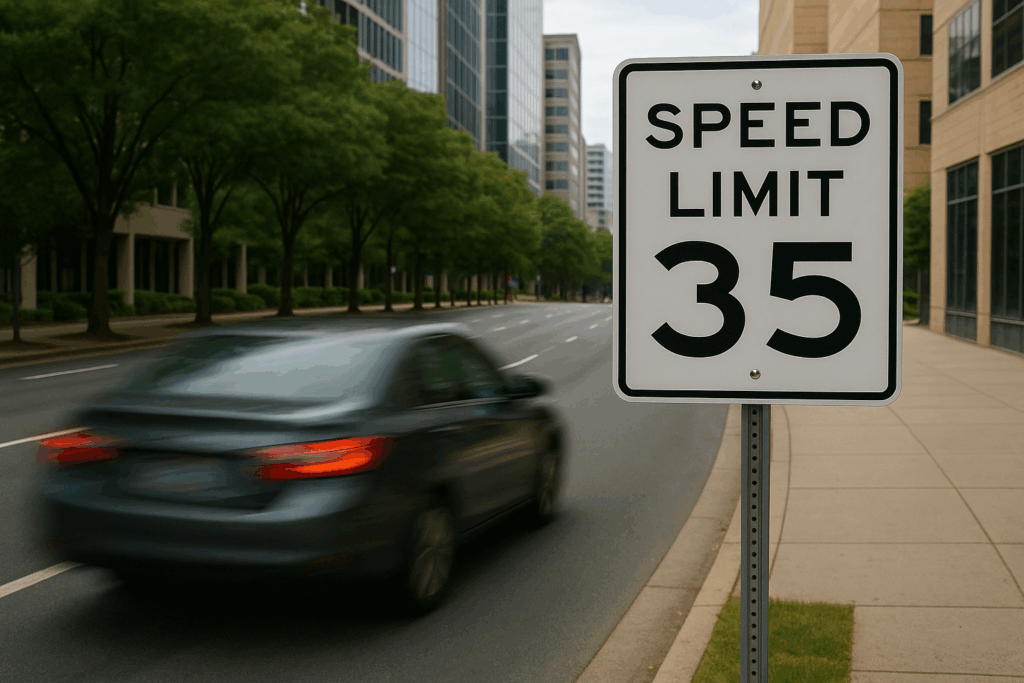

Speeding occurs when a driver exceeds the posted speed limit or travels too fast for current conditions—such as in rain, fog, or construction zones. It’s not just illegal; it’s reckless. Speeding significantly reduces a driver’s reaction time and stopping distance, often resulting in severe crashes that could have been avoided.

The Devastating Consequences of Speeding-Related Accidents

Victims of speeding accidents frequently suffer serious injuries such as traumatic brain injuries, spinal cord damage, and internal trauma. Beyond the physical pain, the emotional and financial toll can be overwhelming—medical bills, lost wages, emotional trauma, and long-term disability. At our firm, we believe that no one should suffer these burdens alone.

Your Advocate for Justice

With offices in Charlotte and throughout North Carolina and a proven track record in personal injury, premises liability, and car accident cases, The Law Offices of Jason E. Taylor is here to help. Backed by positive client reviews and decades of experience, we offer free consultations to discuss your legal options and begin building a strong case on your behalf.

Understanding the Risks and Consequences of Speeding

How Speeding Impairs Driving Ability

Driving at high speeds shortens reaction times and increases the distance needed to stop safely. For example, while it takes approximately 120 feet to stop at 40 mph, that distance nearly doubles at 60 mph. Speeding also makes it harder to control the vehicle and avoid road hazards.

Beyond the Immediate Crash

Speeding leads not only to collisions but also to consequences like costly fines, points on your license, and increased insurance premiums. Speeding in school or work zones carries especially harsh penalties due to the added risk to vulnerable pedestrians and workers.

Charlotte’s Speeding Laws and Penalties

Speeding as Negligence

In North Carolina, speeding is considered negligence—a failure to use reasonable care. If a speeding driver causes an accident, their actions may serve as direct evidence of fault.

Absolute Speed Limits

North Carolina law enforces the following speed limits in Charlotte, unless otherwise posted:

- 35 mph within city or town limits

- 55 mph outside municipal limits

- 70 mph on interstate highways

Exceeding these limits, especially by 15 mph or more, can result in severe penalties.

Penalties and Serious Offenses

Speeding can lead to fines, points on your driving record, and even license suspension. More serious violations—like driving over 80 mph or engaging in street racing—are classified as misdemeanors, and may result in jail time, vehicle impoundment, and permanent criminal records.

How Speed is Determined in Accident Investigations

The Role of Fault in Personal Injury Claims

Under North Carolina’s contributory negligence rule, you may be barred from recovering compensation if you’re found even 1% at fault. That’s why proving the other driver’s excessive speed is critical to your case.

Evidence That Proves Speeding

Our legal team uses various forms of evidence to demonstrate a driver’s speed at the time of a crash:

- Police reports and traffic citations

- Black box (event data recorder) data

- Skid marks and crash impact analysis

- Witness testimony and surveillance footage

- Accident reconstruction experts

The Financial and Legal Impact of Speeding

What Compensation Can Victims Recover?

If you’ve been injured in a speeding-related crash in Charlote, you may be entitled to compensation for:

- Medical expenses (current and future)

- Lost wages

- Pain and suffering

- Emotional distress

- Permanent disability

- Property damage

These damages can be both economic (tangible costs like medical bills) and non-economic (intangible losses like reduced quality of life).

Common Injuries From Speeding Accidents

Injuries can be catastrophic and may include:

- Whiplash and back injuries

- Traumatic brain injuries (TBI)

- Broken bones and lacerations

- Internal bleeding

- Paralysis

What to Do After a Speeding-Related Accident in Charlotte, NC

Taking the right steps immediately after a crash can protect your health and your legal rights:

- Call 911 and seek medical attention.

- Report the accident to law enforcement.

- Document the scene: Take photos, get witness contact info, and record details.

- Exchange information with the other driver.

- Seek medical treatment promptly—even if symptoms seem minor.

- Call an attorney at the Law Offices of Jason E. Taylor to begin protecting your claim right away.

Mistakes That Could Cost You Compensation

Avoid these common errors:

- Failing to collect evidence or medical records

- Giving recorded statements to insurers

- Signing forms without legal advice

- Missing medical appointments

- Admitting any fault—even a little—due to North Carolina’s strict contributory negligence law

Speeding-Related Accidents by the Numbers

According to the NHTSA, speeding is a factor in nearly one-third of all fatal crashes nationwide. In North Carolina:

- Over 20% of crashes are linked to speeding

- Speeding accounts for more than 36% of crash injuries

- Half of teen crash fatalities involve excessive speed

Speeding is especially deadly in rural areas, and fatalities are more common during nighttime hours in urban settings.

Preventing Speeding Fatalities: A Community Responsibility

The solution starts with awareness and accountability:

- Public education through media campaigns and school programs

- Law enforcement visibility through speed patrols and checkpoints

- Better infrastructure, including speed bumps and improved signage

- Technology, such as speed limiters and red-light cameras

Conclusion: Take Action with The Law Offices of Jason E. Taylor

Speeding endangers lives and has devastating consequences. If you or someone you love has been injured in a crash caused by a speeding driver in Charlotte, don’t face the aftermath alone. You deserve a legal team that’s knowledgeable, compassionate, and relentless in pursuit of justice.

The Law Offices of Jason E. Taylor is here to help—24/7. With multiple offices across North Carolina and a no-fee-unless-we-win policy, we make it easy to take the first step.

Schedule your free consultation today.

Call us now or fill out our online form to speak with an attorney.

Frequently Asked Questions

Q: What should I do immediately after a speeding-related accident?

A: Call 911, get medical help, document the scene, exchange info, and contact a personal injury lawyer at the Law Offices of Jason E. Taylor.

Q: How does North Carolina’s contributory negligence law affect my case?

A: If you are even 1% at fault, you may be barred from recovery. This is why legal representation is crucial.

Q: What compensation can I recover?

A: Medical bills, lost income, pain and suffering, emotional distress, and more.

Q: How does a lawyer prove the other driver was speeding?

A: Through police reports, black box data, witness statements, and accident reconstruction experts.

Q: What if the driver was also under the influence?

A: This strengthens your case by showing clear recklessness and may lead to criminal penalties against the driver.