A pesar de lo famoso y conocido que es Allstate, su reputación como proveedor líder de seguros de automóviles ha disminuido en los últimos años. Como una de las aseguradoras más grandes de la industria, la compañía somete a las víctimas lesionadas a un largo proceso de reclamo que a menudo las deja sin la compensación que merecen.

Si resultó lesionado en un accidente automovilístico en Concord, podría tener derecho a una compensación de Allstate. Póngase en contacto con las Oficinas Legales de Jason E. Taylor hoy para una consulta gratuita y conozca cómo nuestros abogados de accidentes automovilísticos pueden ayudarlo a obtener el apoyo financiero que necesita.

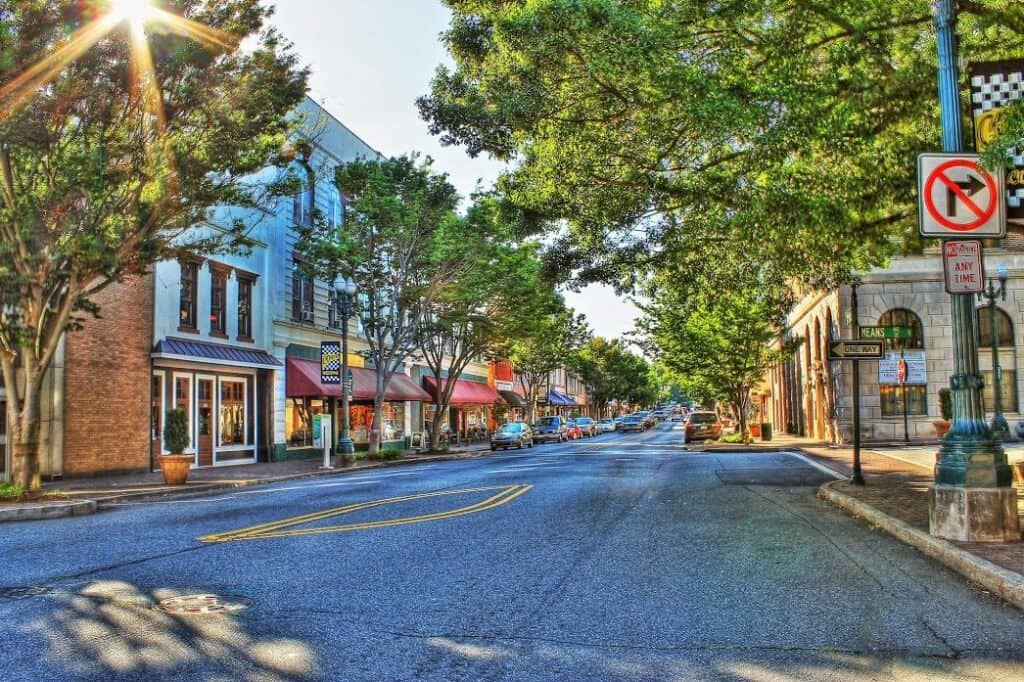

Desafíos de reclamos por accidentes de seguros de automóviles de Allstate en Concord, Carolina del Norte

Como víctima de un accidente automovilístico, tiene derecho a recuperar una compensación por sus pérdidas. Sin embargo, recuperar una compensación requiere un cumplimiento estricto de las políticas y procedimientos de la aseguradora. Allstate, como muchas grandes aseguradoras, implica completar los formularios correctos y enumerar los detalles de sus daños.

Al igual que con cualquier reclamo por accidente, debe respaldar su reclamo con documentación sobre la causa de la colisión, las lesiones que sufrió, el tratamiento médico que recibió y otra información relevante. Desafortunadamente, incluso cuando se proporciona toda esta información, el proceso de reclamo puede no ser tan fácil como parece.

El tasador de seguros asignado a su caso analizará cada parte de su reclamo, buscando razones para rechazar su reclamo o reducir la oferta de acuerdo. Los ajustadores de seguros están capacitados para conocer trucos y tácticas que pueden utilizar para disuadirlo de ejercer sus derechos. El ajustador puede decirle:

- El asegurado no tuvo la culpa

- Sus lesiones no son lo suficientemente graves como para justificar una compensación

- Tuviste la culpa del accidente.

- Su oferta inicial es lo máximo a lo que tienes derecho

- El litigio no vale la pena ni el tiempo ni el dinero

En Las Oficinas Legales de Jason E. Taylor, sabemos la verdad. Sabemos que las compañías de seguros intentarán intimidarlo y convencerlo de que su oferta es justa. Pero muchas veces no lo es.

El acuerdo de seguro promedio es sólo una fracción de lo que un abogado experimentado puede obtener por usted. Podemos ayudarlo a obtener la compensación que se merece para que pueda concentrarse en recuperarse de sus lesiones en lugar de preocuparse por cómo pagar las facturas médicas.

Compensación por un reclamo por accidente automovilístico en Allstate

La compensación que puede recibir de un reclamo por accidente automovilístico en Allstate se basa en la gravedad de sus lesiones y en cuánto dinero cuesta tratarlas.

En general, cuanto más grave sea una lesión y más tiempo tarde en sanar, mayor será su indemnización. Si está permanentemente discapacitado o desfigurado, es posible que tenga derecho a una compensación adicional por esas lesiones permanentes.

Cuando contrata a un abogado que comprende los trucos que utilizan los representantes de seguros para luchar contra su reclamo, aumenta sus posibilidades de recibir un acuerdo justo. Con la ayuda de un asesor legal, es posible que pueda recuperar lo siguiente:

- Costos médicos

- Ingresos perdidos

- Dolor y sufrimiento

- Angustia emocional

- Cicatrización y desfiguración

Si ha perdido a un ser querido, es posible que también tenga derecho a una compensación por los gastos funerarios y la pérdida de compañía y apoyo. Si está listo para presentar un reclamo contra el conductor culpable, comuníquese hoy con un abogado experimentado.

¿Cuánto tiempo tarda Allstate en resolver reclamos en Concord?

Normalmente, el tiempo que lleva resolver un caso depende de su recuperación. Si se acepta o no la responsabilidad es otro factor que determina cuánto tiempo llevará finalizar su reclamo. Por ejemplo, si tiene una disputa con la compañía de seguros sobre quién tiene la culpa o si sus lesiones son resultado de la colisión, puede llevar mucho más tiempo resolver su caso. También debe tener cuidado con una oferta de acuerdo que llega demasiado rápido. Siempre comuníquese con un abogado si tiene alguna pregunta sobre la validez de su reclamo o si no está recibiendo un trato justo por parte de los representantes de Allstate.

Por qué debería esperar para hacer una declaración o enviar una autorización médica a Allstate

Cuando usted hace una declaración o da una autorización a Allstate, es importante saber que la aseguradora puede usar esos elementos en su contra. Si dice una cosa pero luego cambia de opinión sobre cómo ocurrió el accidente, la compañía de seguros puede usar esta discrepancia como excusa para no pagar su reclamo.

Antes de dar una declaración o firmar una autorización, es mejor esperar hasta haber hablado con un abogado. Su abogado puede ayudarlo a decidir qué declaraciones o exenciones son apropiadas para la situación y aconsejarle cómo tomar las decisiones más beneficiosas para su reclamo.

Póngase en contacto con las oficinas legales de Jason E. Taylor en Concord, Carolina del Norte hoy

Si resulta lesionado en un accidente, lo último que desea es verse atrapado en disputas legales. Además de lidiar con el dolor de sus lesiones, es posible que tenga muchas preguntas sobre lo que sucedió y cómo afectará su caso. Lo último que necesita es más estrés y preocupación por si su compañía de seguros pagará o no los daños causados por su conductor asegurado.Las Oficinas Legales de Jason E. Taylor pueden ayudarlo a obtener la compensación que merece por sus lesiones. Nuestros abogados de accidentes automovilísticos lucharán para recuperar salarios perdidos, gastos médicos y otros daños relacionados con su reclamo por accidente automovilístico. Trabajamos sobre una base de contingencia , lo que significa que no nos pagan a menos que usted lo haga. Póngase en contacto con nosotros hoy para una consulta gratuita.